About Monzo

| Name: | Monzo |

| Price: | Monzo |

| Version: | 3.63.0 |

| Author: | Monzo |

| Category: | finance |

| Package: | co.uk.getmondo |

Updates

Here are some of the new features in the latest version of the Monzo app:

- Overview (new home screen): The app now includes a new home screen called Overview. This screen gives you a quick overview of your finances, including your balance, recent transactions, and spending categories.

- Credit Card Pot: The app now includes a new feature called Credit Card Pot. This feature allows you to save money specifically for your credit card bills.

- Round-ups: The app now includes a new feature called Round-ups. This feature rounds up your purchases to the nearest pound and saves the difference in a separate pot.

- Other improvements: The app has also been updated with a number of other improvements, such as bug fixes and performance improvements.

Here are some specific details about the new features in the latest version of the Monzo app:

Overview (new home screen):

The new Overview screen gives you a quick overview of your finances, including your balance, recent transactions, and spending categories. The screen is divided into four sections:

- Balance: This section shows your current balance, as well as your available balance and your overdraft limit.

- Recent: This section shows your most recent transactions. You can swipe left or right to see more transactions.

- Categories: This section shows your spending categories. You can tap on a category to see more details about your spending in that category.

- Goals: This section shows your financial goals. You can tap on a goal to see more details about your progress towards that goal.

Credit Card Pot: The Credit Card Pot feature allows you to save money specifically for your credit card bills. To create a Credit Card Pot, go to the Pots tab and tap on the + button. Then, select the Credit Card Pot option. You can then set a goal for your Credit Card Pot and start saving money.

Round-ups: The Round-ups feature rounds up your purchases to the nearest pound and saves the difference in a separate pot. To enable Round-ups, go to the Pots tab and tap on the + button. Then, select the Round-ups option. You can then choose which pot you want your Round-ups to go into.

Other improvements: The app has also been updated with a number of other improvements, such as bug fixes and performance improvements. These fixes and improvements should make the app more stable and reliable.

Introducing Monzo – The Cool UK Bank Now in America

Monzo is one of the UK’s fastest-growing banks, and it is now available in the United States. This innovative banking app offers features such as instant spending notifications, budgeting tools, and real human support when you need it. In this article, we explore the pros and cons of Monzo and provide a guide on how to use the app to its full potential.

Features of Monzo

One of the main features of Monzo is its instant spending notifications. Whenever you pay for something with your Monzo card, you will receive a notification on your phone in real-time. The balance will update immediately, keeping you up-to-date with your spending. This feature is excellent for budgeting as you can keep track of how much you are spending.

Monzo also offers the ease of traveling without stress. You can use your coral debit card or Google Pay anywhere in the world without having to notify Monzo beforehand. Moreover, the bank doesn’t charge fees when you spend abroad. That makes it an excellent option for traveling to different countries.

Pros of Monzo

One of the most significant advantages of Monzo is its fee-free transactions. There are no charges for spending on your card or overdraft fees. Additionally, there are no foreign exchange fees for spending abroad, which can save you a considerable amount of money.

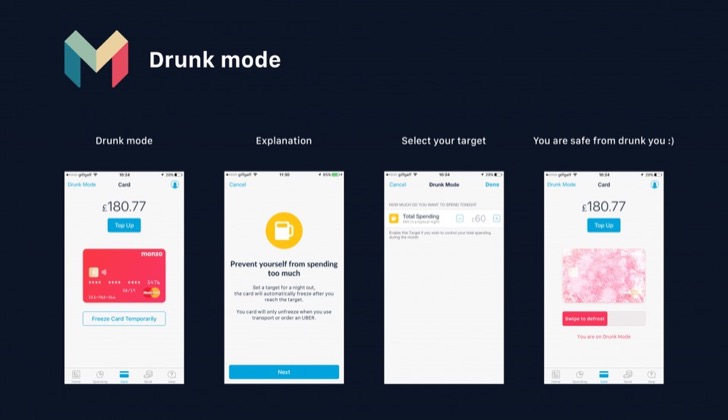

Another benefit is the effortless way to send and receive money. You can send and receive money instantly with other Monzo users, and you can add emojis to express your gratitude. Additionally, Monzo users can freeze their card in the app in case they lose it, and quickly defrost it once they find it without any problems.

Cons of Monzo

The primary downside of Monzo is that the bank is not FDIC-insured, which may be a concern to some US residents. However, an advantage in this area is that Monzo's anti-fraud system provides security for its users, ensuring that their money is safe.

How to Use Monzo

Signing up for Monzo is a straightforward process that you can complete entirely on your phone. Once you have an account, you can start making transactions and receive instant notifications. To get the most out of the app, you can set daily or monthly budgets to help with financial planning. You can also categorize your transactions to see how much you spend and where.

In conclusion, Monzo is an excellent banking option, particularly for US residents who love to travel or want a better way to manage their finances. With its user-friendly app design, accessibility, and real-time notifications, Monzo is sure to give its users stress-free banking experiences.

FAQs

Is Monzo a bank?

No. Monzo Inc. is not a bank, but a wholly-owned subsidiary of Monzo Bank Limited, which is a non-US bank.

Is Monzo FDIC-insured?

No, Monzo Bank Limited is a non-US bank and is therefore not FDIC-insured. However, Monzo does provide security for its users through its anti-fraud system, giving them peace of mind when it comes to their finances.

Is Monzo available internationally?

Monzo currently operates in the United Kingdom and the United States but plans to expand to other countries in the future.